Why Models for Digital Organisations in Oil and Gas Often Struggle to Deliver

30 September 2024 — E&P - Ian Kennedy

Digital organisations in the oil and gas sector face unique hurdles in delivering their services. Energy companies are constantly pressured to cut costs associated with developing, implementing, and supporting complex systems for discovering, producing, refining, and marketing hydrocarbons. However, the problem isn't just about cutting costs—it's also the approach being taken.

Many companies are stuck in a loop of cost reduction, reinvention, and reorganisation, which often undermines their medium-to-long-term digital efforts. As digital domain consultants with a long history of supporting digital initiatives within oil and gas, we have direct experience of the issues that digital organisations are facing in the oil and gas domain. These issues typically arise from four interconnected challenges.

1) Context vs. Commodity

Constant simplification and cost-cutting erode business understanding. As digital organisations weaken due to constant change, their ability to produce value and stay relevant diminishes. The focus shifts from business value to low-cost solutions, forcing businesses to seek their own solutions and creating an escalating cost spiral as additional business spend is added to existing digital spending.

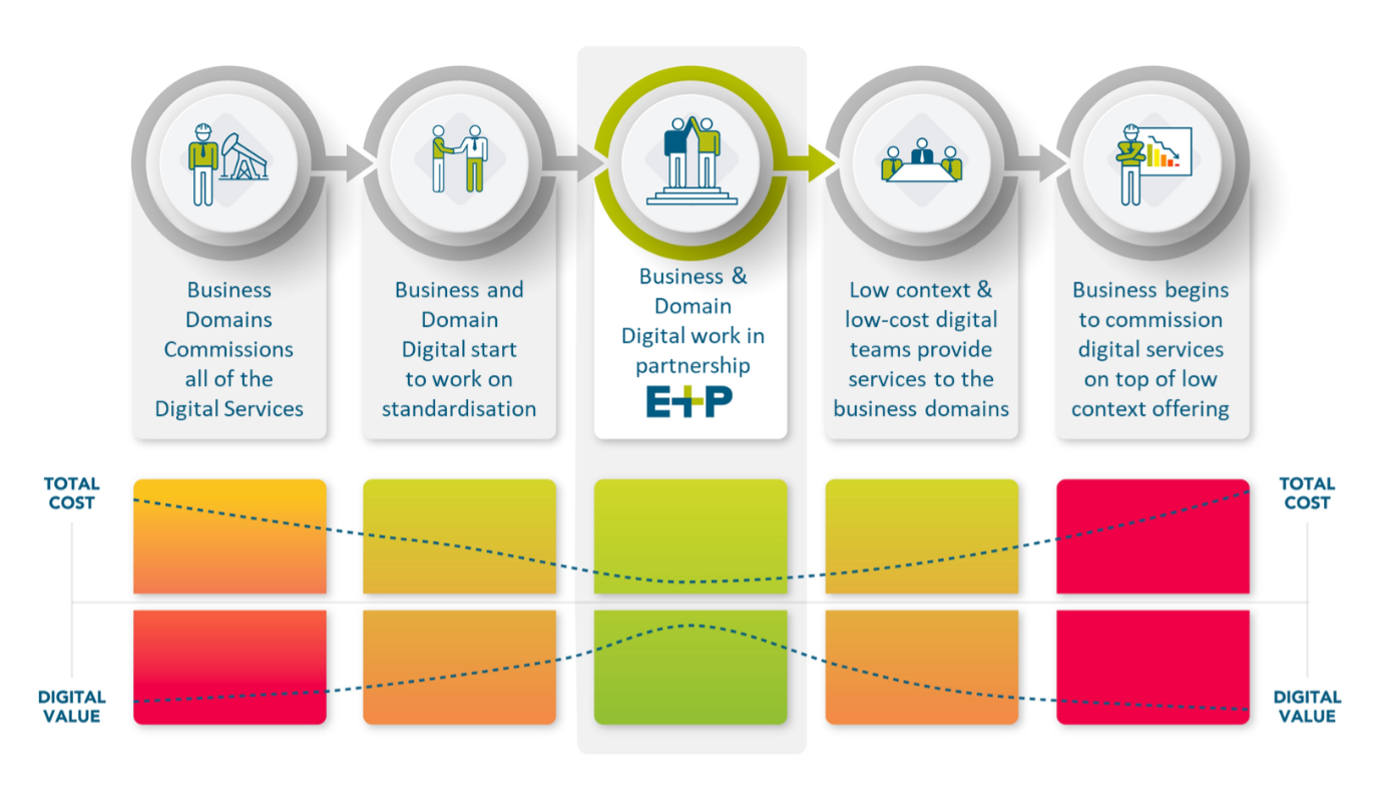

Balancing commodity IT and contextual business understanding is key to a successful partnership between the digital organisation and the business. As demonstrated in Figure 1, Domain SMEs (Subject Matter Experts) bring assurance and credibility, shorten project durations, and reduce the need to divert business resources from key activities. Optimising the ratio of domain IT to commodity IT can save costs without risking the digital organisation becoming irrelevant.

Figure 1: The Domain Digital Cost Value Lifecycle

2) Effect of Continuous Cycles of Reinvention and Reorganisation

Many Fortune 500 oil and gas companies have undergone multiple digital reorganisations within the last decade. According to the top consultancies, implementing, assessing, and understanding the effectiveness of a digital strategy in such companies can take years.

- Initial assessment (6-12 months): Early signs of success or areas needing improvement are identified.

- Short-term results (1-2 years): More concrete results, like cost savings and better data insights, become visible.

- Long-term impact (3-5 years): A full evaluation usually takes at least three years, often five, showing sustained competitive advantages and major improvements in customer experience and business processes.

Frequent and radical change cycles prevent optimisation and seldom realise the value of change, leading to change fatigue.

3) Change Fatigue in Digital Organisations within Oil and Gas

Change fatigue manifests in several ways:

- Decreased enthusiasm: Employees may lack motivation, lowering job satisfaction and morale.

- Resistance to change: Reluctance to participate in new initiatives.

- Reduced productivity: Feeling overwhelmed, resulting in mistakes and poor performance.

- Communication breakdown: Poor information sharing and missed messages.

- Increased stress: Burnout and complaints about workload.

- Decreased trust: Scepticism about leadership and changes.

- Stifled Innovation: Less willingness to take risks or propose new ideas.

- Ignored feedback: Employees feeling undervalued.

4) Fatigue in the Skills Market

These change cycles drive experienced professionals out of the industry and deter new entrants. Consequently, the demand for digitally skilled domain SMEs is rising, but with fewer new entrants and strategy changes leading to layoffs, cost-cutting, and retirements, the talent pool is shrinking. This could collectively result in a 40% reduction in the talent pool by the end of the decade.

To overcome these challenges, companies need to focus on developing talent and working with business-focused digital suppliers (vendors, consultancies, integrators). This approach will help to build a strong pipeline of skilled professionals capable of driving digital transformation in the oil and gas industry.

Conclusion

Whilst continuous cost-cutting and reinvention will weaken digital organisations by eroding business understanding and value, leading to exposure to rising costs, partnering with skilled digital domain consultants will enable organisations in the energy industry to better manage and mitigate these challenges.

We believe that balancing commodity IT with contextual business understanding and employing domain SMEs will optimise projects and save costs without losing relevance. We also believe that investing in talent development and partnering with business-focused digital suppliers remains vital to driving effective digital transformation. Through the right partnership of skilled domain experts, digital organisations can be confident that they are adopting the best approach for optimal results and gain a competitive advantage in the oil and gas domain.

Get in touch today to find out more about how E&P Consulting successfully combines the skills and capabilities needed to effectively utilise the latest digital technologies and models to support digital organisations in oil and gas.

-----

Author

Ian Kennedy, Head of Oil and Gas

As E&P's Head of Oil and Gas, Ian is responsible for developing and promoting E&P's consulting services, ensuring that value is realised from digital technologies within oil and gas organisations. Ian has over 25 years of experience working with major oil, gas, and service companies and leading systems integrators to optimise the use of information technology. His passion is applying the appropriate mix of people, processes, and technology to solve industry challenges.