The Digital Challenge of M&As in Oil and Gas Domains

27 August 2024 — E&P - Ian Stewart

As oil and gas companies continue to evolve and expand through consolidating portfolios, acquiring new assets and market access, and diversifying into alternative energy sectors, mergers and acquisitions (M&As) have become increasingly common for the energy industry. While M&As undoubtedly bring new opportunities and can deliver a competitive advantage, they are inherently complex to undertake. Often the true complexities of an M&A deal are only fully realised once the deal is completed, but companies can take steps to plan for this and mitigate risks, especially from a digital perspective.

What are the main digital challenges of M&As?

As part of the M&A process, companies are challenged with successfully integrating differing corporate cultures and developing effective strategies to communicate with and support newly consolidated teams and stakeholders, all whilst simultaneously maintaining seamless continuity for their new portfolio and on-going projects.

In addition, oil and gas companies face significant risks impacting their digital ecosystems during the M&A process. Digital assets are integral to continued operations and heavily relied upon to make critical business decisions, so successfully integrating these systems during transitions is crucial. This involves ensuring compatibility, adjusting workflows, and managing data to maintain integrity and security.

Companies will also need to adopt an effective change management strategy to support the technical user community through training and resources, with clear communication and collaboration across teams essential to address issues and ensure business continuity.

Failure to plan for and mitigate these challenges can result in significant disruptions to business operations, poor decision-making, and a loss of value with the potential for downtime and missed opportunities.

A well-defined approach to IT during the M&A process that is relevant and tailored to the needs of the oil and gas industry cannot be underestimated. Successful transitions with minimal disruption and maximum benefits require a strategic approach combined with a squad of skilled digital domain experts to help the company navigate digital challenges.

Why is it so important to have the right approach to IT during M&As?

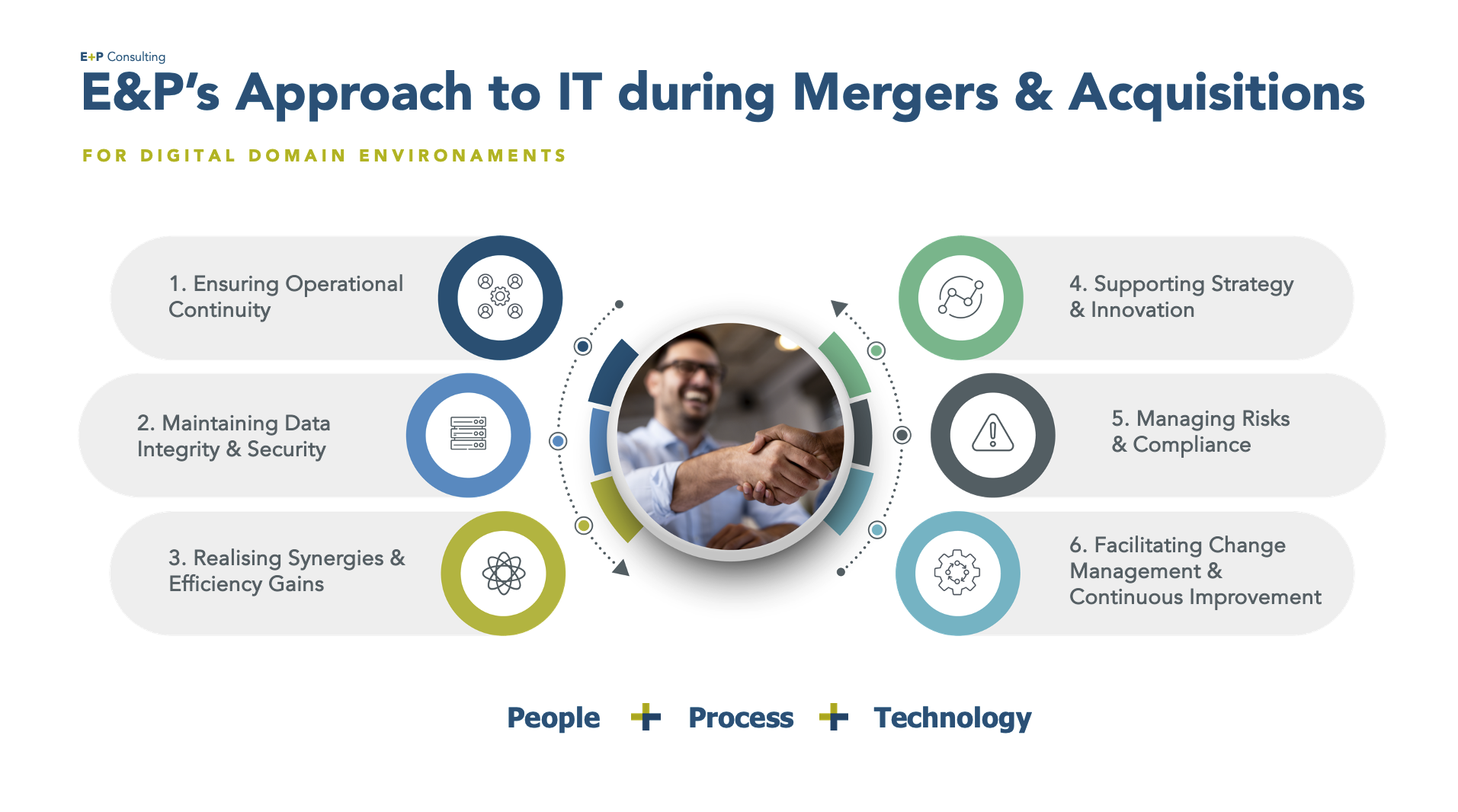

There are many reasons why it is important to adopt the right approach to managing your IT and consolidating your digital assets during the M&A process, but here are six of the most critical reasons that we believe must be addressed for a successful M&A outcome from a digital perspective.

- Ensuring Operational Continuity

Efficient IT integration for uninterrupted exploration and production activities is essential. Addressing these risks includes minimising disruptions in systems and software and ensuring adherence to all relevant legal and regulatory requirements, which will avoid issues and penalties.

- Maintaining Data Integrity and Security

Vulnerabilities in data security can arise in the data migration process during M&A activities. It is vital to ensure high levels of data integrity and security throughout the M&A process. Secure data integration can be achieved by assessing your data and systems for potential risks and putting processes in place to mitigate them. As a result, operational, financial, and cybersecurity risks will be minimised.

- Realising Synergies and Efficiency Gains

M&As provide an ideal opportunity to maximise operational synergies and drive significant efficiency improvements across digital assets. However, this requires relevant digital expertise to leverage digital assets and implement effective and efficient data management processes. Delivering these operational efficiencies enables oil and gas companies to achieve more streamlined operations with increased productivity. This, in turn, can deliver potential cost reductions to the bottom line through optimised resource utilisation.

- Supporting Strategy and Innovation

During the M&A process, companies may acquire new technologies and may also be operating at different stages in their digital transformation journeys. To leverage innovations and newly acquired technologies, it is important to implement strategic integration between companies to enhance operational resilience and adaptability. Achieving robust and adaptable integrated operations will result in more resilient operations.

- Managing Risks and Compliance

During the M&A process, it is vital to ensure you adopt comprehensive risk management practices and strict compliance with legal and regulatory standards. This is an evolving requirement that demands continued assessment, monitoring, controls, and action. Adhering to all relevant legal and regulatory requirements will ensure full compliance, and risk mitigation will also significantly reduce operational, financial, and cybersecurity risks.

- Facilitating Change Management

Successful M&As require successful change management that fosters a culture of continuous improvement. There are many ways to engage with employees and ensure that they are fully invested in the newly established company at each stage of the M&A process. This may include establishing training programs, feedback systems, and leadership engagement to foster positive attitudes and increased satisfaction among employees, customers, and suppliers.

The value of digital domain consultants in the M&A process

The involvement of skilled consultants with digital domain expertise can remove the pain points for oil and gas companies when navigating the challenges of consolidating digital assets and implementing effective risk management strategies for IT. These professionals bring a wealth of knowledge in managing digital content and can offer solutions that not only mitigate risks but also add significant value to the merger or acquisition.

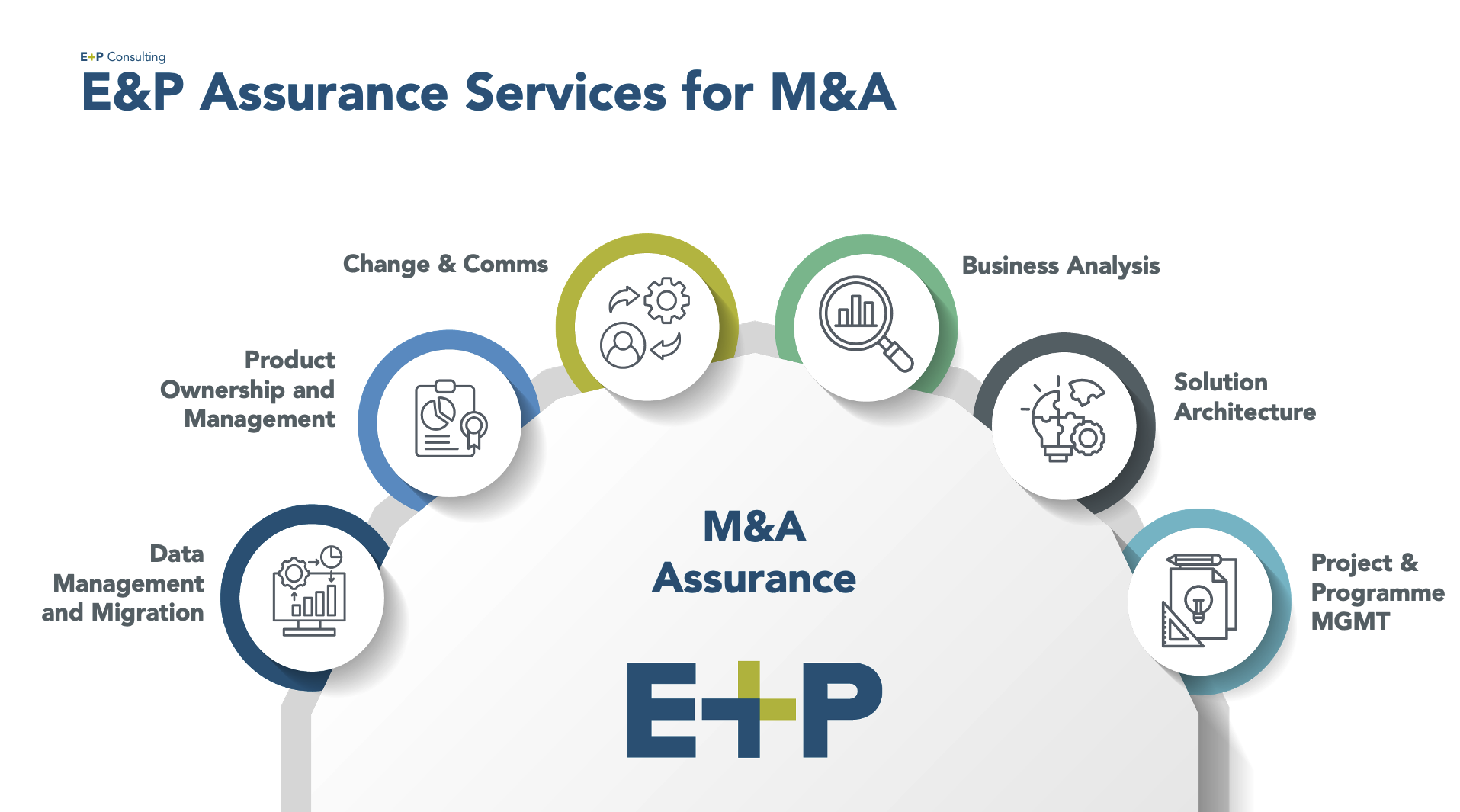

E&P’s Assurance service for M&As offers tailored roles to complement current teams or assemble a complete team from scratch. Whether you need specific expertise or a full squad, our diverse skills enable us to seamlessly collaborate with various groups, including your business, vendors, and IT experts.

E&P’s team of skilled digital domain consultants can support and mitigate multiple challenges during an M&A, including support with data management and migration, product ownership and management, change management and communications, business analysis, solution architecture, and project and programme MGMT.

As domain systems and data integrators (SDI), we help our customers improve workflows and insights by taking a unified view across data and applications. This approach, supported by established and new processes and technology, ensures organisations have access to dependable information for smarter decisions and better results.

E&P’s approach to successful M&As from a digital perspective

At E&P Consulting, we understand that the sector's complexity, reliance on technology, and the critical nature of its operations make it essential to manage IT integration effectively. We work closely with our clients to enable them to establish an effective strategic approach to plan for and mitigate challenges related to consolidating digital assets.

As a domain data and systems integrator, our model outlines the specialised offerings and approach focused on integrating systems and data across or within industry domains.

During the M&A process, our approach and model addresses the critical areas for effective and efficient IT and digital asset management. This includes

- Ensuring operational continuity

- Maintaining data integrity and security

- Realising synergies and efficiency gains

- Supporting strategy and innovation

- Managing risks and compliance

- Facilitating change management and continuous improvement

The following case study demonstrate E&P’s approach to supporting M&As in upstream oil and gas from a digital perspective.

Case Study: Delivering seamless data migration to support an upstream oil and gas M&A deal

Overview

Following the sale of our client’s downstream business, all relevant sub-surface technical data needed to be migrated to the buying company. There were several key challenges that had to be overcome during the transition:

- Difficulty establishing the definitive models from interim non-definitive working models (other than the limited set provided in the pre-sale data room).

- Clearly understanding the licensing constraints associated with passing interpreted data and raw seismic data between different corporate entities (when only one entity has a license) and the transferability of licenses.

- Identifying key physical data (e.g., core samples or paper well logs) that needed to be passed to the new company when supporting documentation was of an inconsistent quality.

What we did

A cross-discipline team was formed to tackle each of these problems, including financial incentives for key personnel to remain in the purchased company. Legal representation was needed to interpret license contract terms correctly, and automated scripting was used to provide first-pass analysis of data models to exclude those least likely to be candidates for transfer based on age or location. Physical archival records were systematically assessed against sale requirements and digitised to minimise physical transfer and ongoing storage costs.

Outcome

Physical records were reduced by 40%, and data transfer by 35%. Critically, significant potential liabilities associated with license breaches were avoided by the purchasing company. Key personnel remained within the transfer team until completion, retaining key institutional and historical knowledge and enabling knowledge transfer.

Why choose E&P to support your M&A activity?

With E&P’s approach to managing digital assets during the M&A process, companies in the energy industry will realise benefits and gain added value in four key areas:

Business Continuity: By having a team that has a deep understanding of the business and the technology, the E&P team will ensure that critical business operations are not disrupted during the integration process. This is achieved by systematic and careful planning with phased rollouts.

Risk Reduction: E&P’s deep industry knowledge will mitigate key risk areas such as licensing obligations, data sovereignty, digital security, and software portfolio management. This will reduce the risk of potential legal, safety, technical, or commercial issues, which can cause delays to M&A activity or harm the purchasing company further down the road.

Optimised Operations: E&P’s digital and data domain experience combined with our M&A experience helps identify opportunities to improve current and future digital and data operations during the transition—not simply just ‘lift and shift’. This results in an optimised set of digital products and services that deliver more for less.

Cost Management: Using an experienced domain team will give the best chance of controlling resource costs by delivering the following:

- Minimal onboarding and ramp up

- Accurate basis for estimate

- Reduce chances of unexpected spend

- Smaller team covering a wider scope

Overall, the team at E&P Consulting understands that the skills, processes, and methodologies required to undertake M&A within the energy industry are complex and wide-ranging. With a solid understanding of the business, deep domain knowledge, and technical experience, we can confidently de-risk any transition and can help companies in the energy industry maximise the potential for a successful merger, acquisition, or divestment.

Get in touch with us today to find out more about how E&P Consulting successfully combines the skills and capabilities needed to effectively utilise the latest digital technologies and data analytics techniques to support M&A activities in the energy industry.

-----

Author

Ian Stewart - Upstream Lead, E&P Consulting

Ian Stewart is E&P's Upstream Lead, responsible for developing and promoting E&P’s services to ensure that value is realised from technologies supporting the functions within exploration and production organisations.